|

Prime Cost

Prime

Cost is the total of direct materials, direct labor and direct expenses. These

are all costs or expenses incurred directly to produce product or service. Prime

Cost excludes Overhead Expenses. The formula to compute Prime Cost is below:

Prime

Cost = Direct Material Cost + Direct Labor Cost + Direct Expenses

Direct

Material Cost is the cost of all raw materials, specialized parts and

sub-assemblies that are allocated directly to produce product.

Direct

Labor Cost is the total of the salary/wage and other costs related to hiring

workers involved in the production process. The formula to calculate Direct

Labor Cost can be represented in the following way:

Direct

Labor Cost = Wages + Other Direct Labor Costs = Job Time * Wage + pension

contributions + employee insurance + payroll tax + other direct labor costs

Direct

Expenses include miscellaneous expenses for materials and labor charged to

product or service, e.g. consumables that go along with product, power, fuel

used to produce product.

Prime

Cost is important for computing total cost of production and defining selling

prices for finished products. To make profit the selling price should cover the

cost of products sold and SG&A

Expenses (or period expenses).

To calculate Prime Cost please follow the steps below:

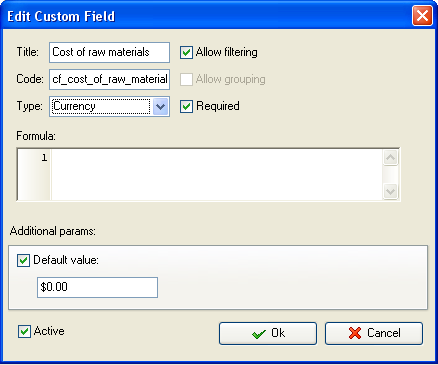

-

Add custom field “Cost of raw materials ” or “Direct

Material Cost” with Code “cf_cost_of_raw_materials”

Add the cost for all materials produced or purchased to make a finished

product

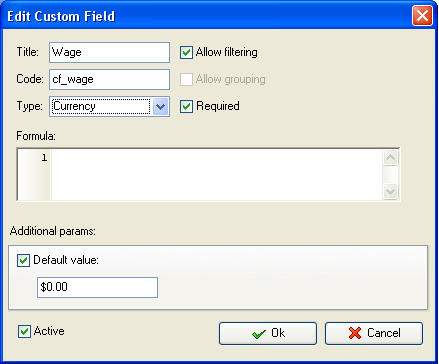

-

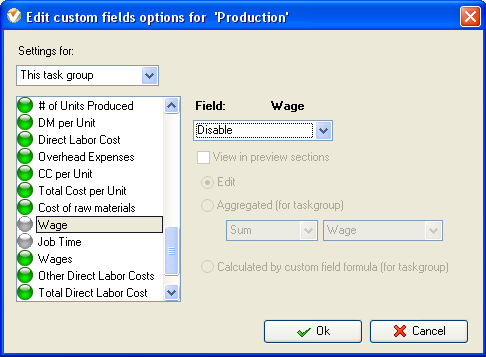

Add custom field “Wage” with Code “wage”

Add the salary of each employee to this custom field

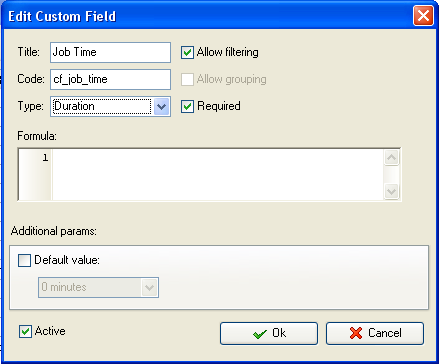

-

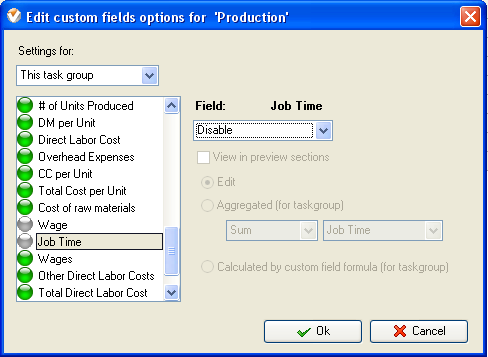

Add custom field “Job Time” with code “cf_job_time”

Enter working hours of each employee in this custom field.

Note: Custom fields “Wage” and “Job Time” should be calculated at task

level for particular employees.

-

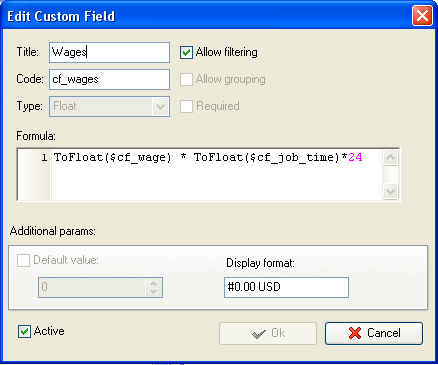

Add custom field “Wages” with Code “cf_wages” and

formula:

ToFloat($cf_wage) * ToFloat($cf_job_time)*24

-

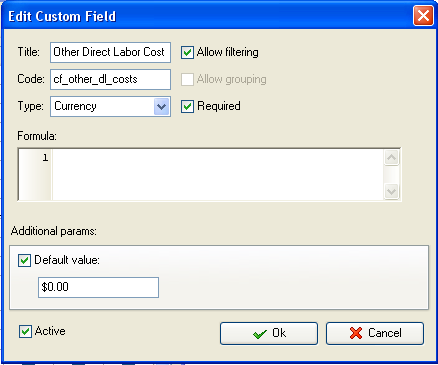

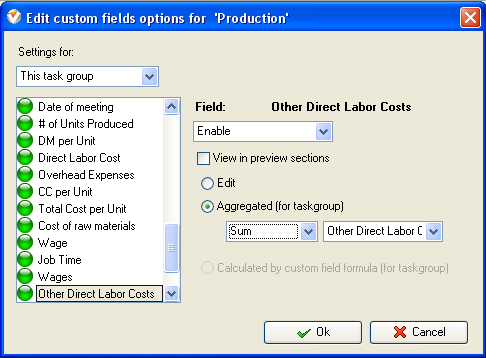

Add custom field “Other Direct Labor Costs” with Code

“cf_other_dl_costs”

Note: you can create separate custom fields for Direct Labor items

(pension contributions, employee insurance, payroll tax, other direct labor

costs) and then calculate the total using another custom field or add total

amount of other Direct Labor items to one custom field “Other Direct Labor

Costs”

-

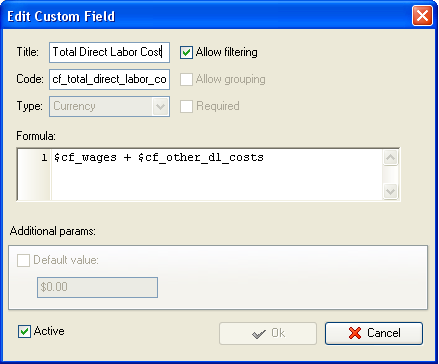

Add custom field “Total Direct Labor Cost” with code “cf_direct_labor_cost”

and formula:

$cf_wages + $cf_other_dl_costs

-

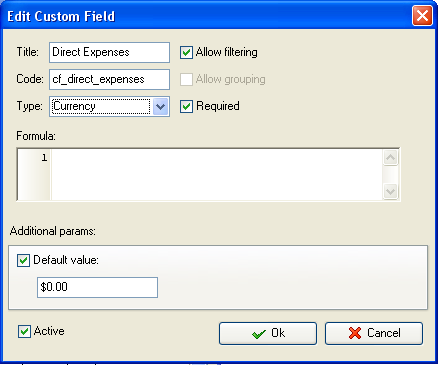

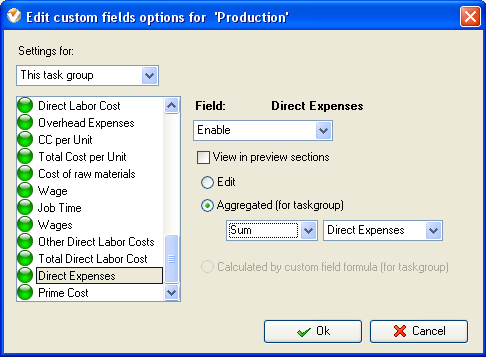

Add custom field “Direct Expenses” with Code “cf_direct_expenses”

Add all extra expenses related to product or labor.

-

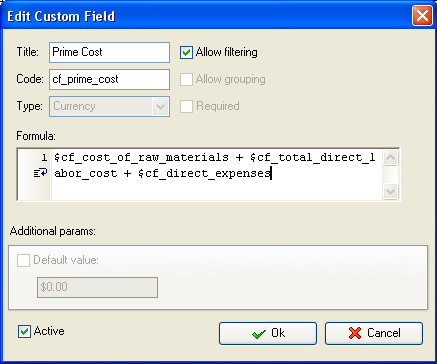

Add custom field “Prime Cost” with formula:

$cf_cost_of_raw_materials + $cf_total_direct_labor_cost +

$cf_direct_expenses

-

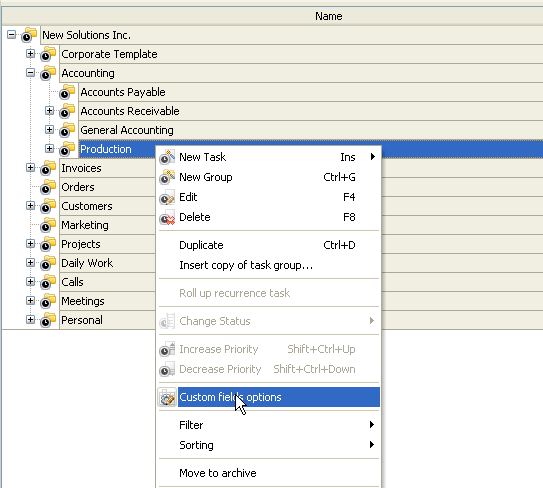

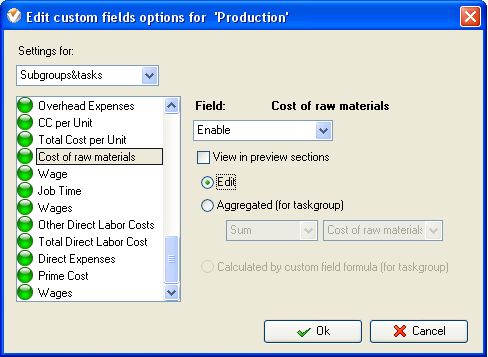

On Task Tree select task group

for which you need to display Prime Cost and select “Custom

fields options”

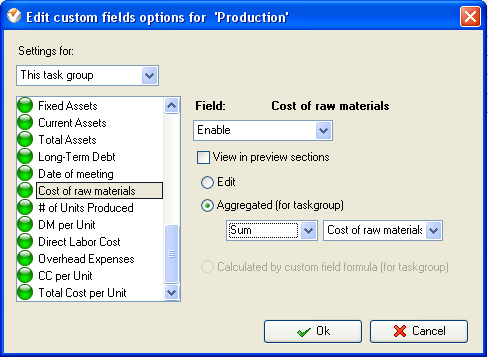

For custom fields “Cost of raw materials” (or “Direct Material Cost”), “Wages,

“Other Direct Labor Costs” and “Direct Expenses” set

the following custom fields settings:

- In “Settings for” select “This task group”

- select “Enable”

- in “Aggregated (for task group)” field select “Sum” from drop-down list and the corresponding custom field name:

To prevent custom fields “Wage” and “Job Time” from showing at task group

level select “Disable”

-

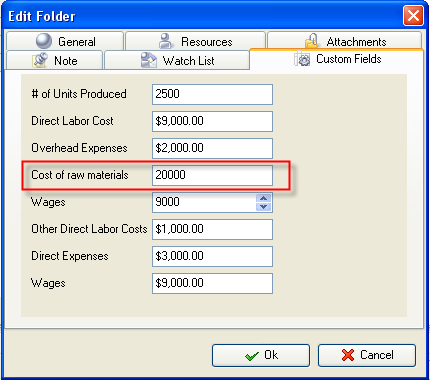

If you need to fill in custom

fields at task group level, right click on task group, select “Custom fields

options” and select “Edit” for the corresponding custom field

-

To fill in the custom fields at the task group right

click on task group and select “Edit”

-

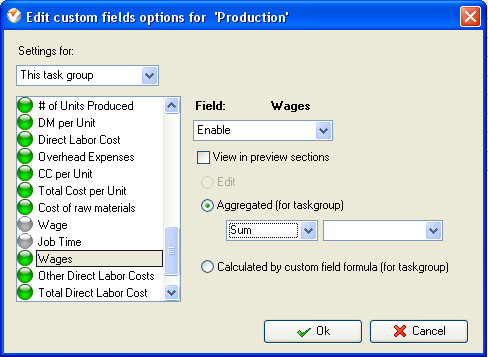

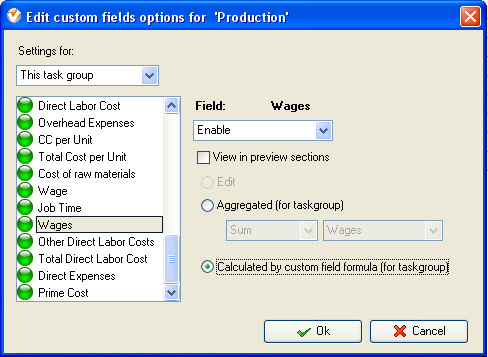

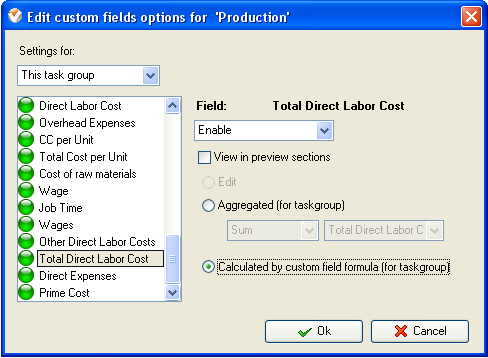

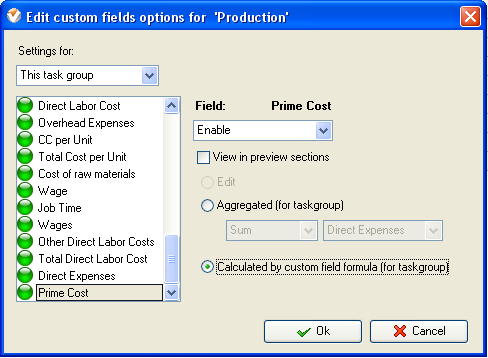

For custom fields “Wages”, “Total Direct

Labor Cost” and “Prime Cost” set the following settings for

these custom fields:

- In “Settings for” select “This task group”

- select “Enable”

- select “Calculated by custom field formula (for task group)”

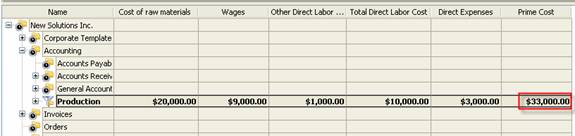

Prime Cost on Task Tree

|